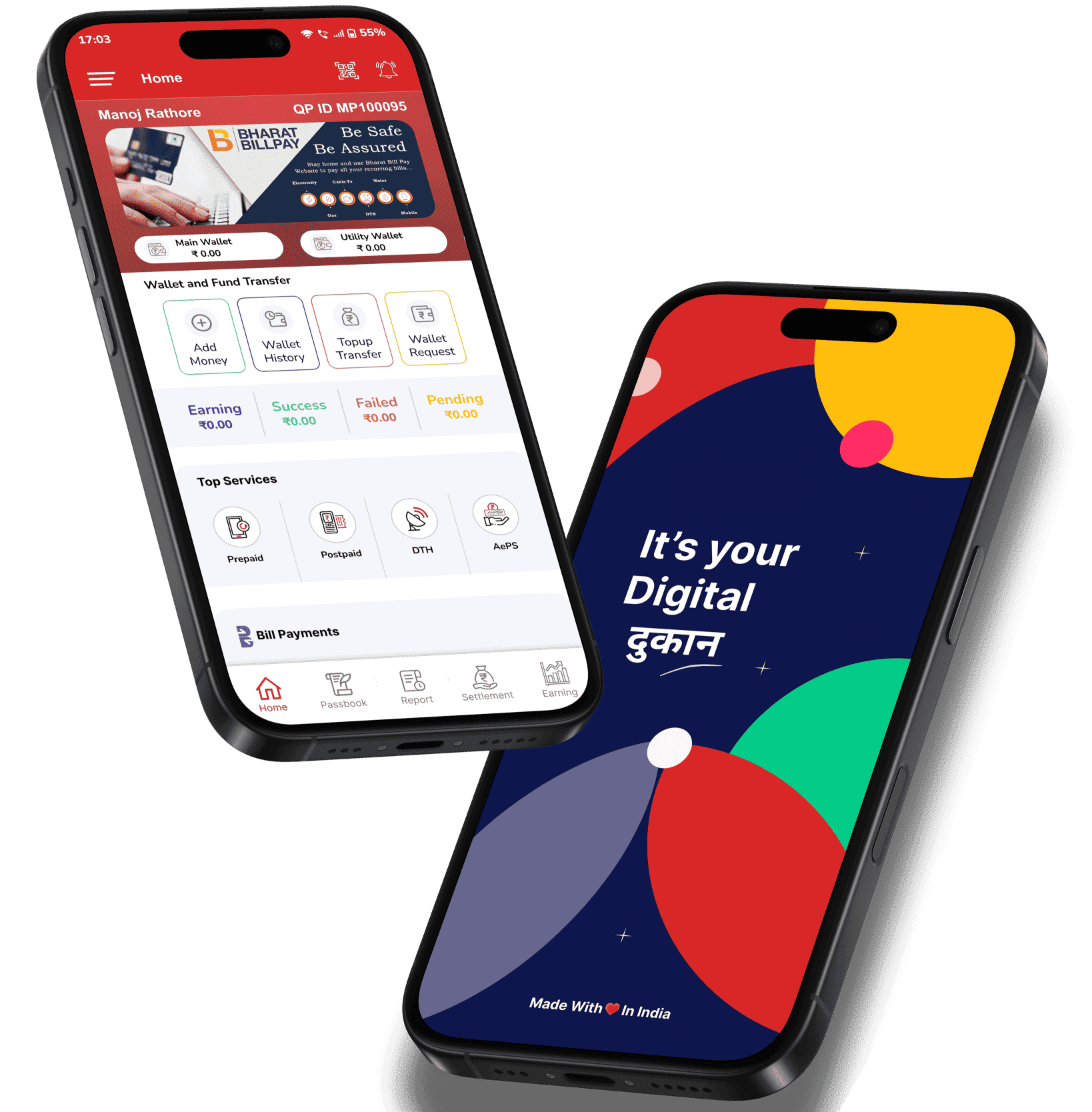

Aadhaar Enabled Payment System (AePS)

AePS is a secure digital payment system that allows bank customers to conduct financial transactions using their Aadhaar number and biometric authentication.

It enables services like cash withdrawal, balance inquiry, fund transfer, and mini statements through micro ATMs and banking correspondents.

Cash Withdrawal

Cash withdrawal allows individuals to access their funds from banks or ATMs. Limits may apply depending on the institution. Secure transactions are essential to prevent fraud and ensure financial safety for users.

Balance Inquiry

Balance inquiry helps account holders check their available funds through ATMs, mobile apps, or bank branches. It ensures financial awareness, prevents overdrafts, and helps manage expenses efficiently for better money control.

Mini Statements

A mini statement provides a brief transaction history, showing recent deposits, withdrawals, and balances. It helps account holders track spending, manage finances, and stay updated on their banking activities efficiently.

Aadhaar Pay

Aadhaar Pay is a digital payment system enabling cashless transactions using Aadhaar-linked bank accounts. It allows merchants to receive payments securely through biometric authentication, promoting financial inclusion and seamless transactions.

DMT (Domestic Money Transfer)

Domestic Money Transfer (DMT) is a financial service that allows individuals to transfer money within a country quickly and securely. It enables instant fund transfers, benefiting unbanked users and those needing urgent transactions.

Introduction to DMT

Domestic Money Transfer (DMT) is a financial service that allows individuals to transfer money within a country securely and instantly. It is widely used for sending funds to family, friends, or businesses.

Key Features of DMT

DMT enables quick fund transfers without requiring a bank account. Transactions can be done through mobile apps, banking agents, or retail outlets, providing convenience and accessibility to users.

Benefits of DMT

DMT helps unbanked and underbanked individuals by offering a hassle-free way to send money. It supports financial inclusion, provides real-time transactions, and is essential for emergency fund transfers.

Payout

Payout refers to the distribution of funds, such as salaries, dividends, or settlements. It ensures timely payments through digital platforms, bank transfers, or cash, benefiting businesses, employees, and service providers with smooth financial transactions.

Introduction to Payout

Payout refers to the process of disbursing funds for salaries, vendor payments, dividends, or other financial transactions. It ensures smooth cash flow management for businesses and individuals.

Key Features of Payout

Payouts can be processed through bank transfers, digital wallets, or cash. Automated systems enable bulk payments, reducing manual effort and ensuring timely transactions.

Benefits of Payout

A well-structured payout system enhances efficiency, ensures compliance, and improves trust between businesses and stakeholders. It supports seamless financial operations and minimizes delays.

Testimonial

You can see our clients feedback what you say?

The seamless integration of their API has enhanced our platform’s functionality. It’s a game-changer for offering reliable fintech services to our users!

Partnering with this fintech platform has streamlined our business operations, making transactions faster and more secure. Highly recommend their services to all retailers!

As a distributor, the support and resources provided by the team have helped grow my network and customer base. Fantastic service, and the app is easy to use!